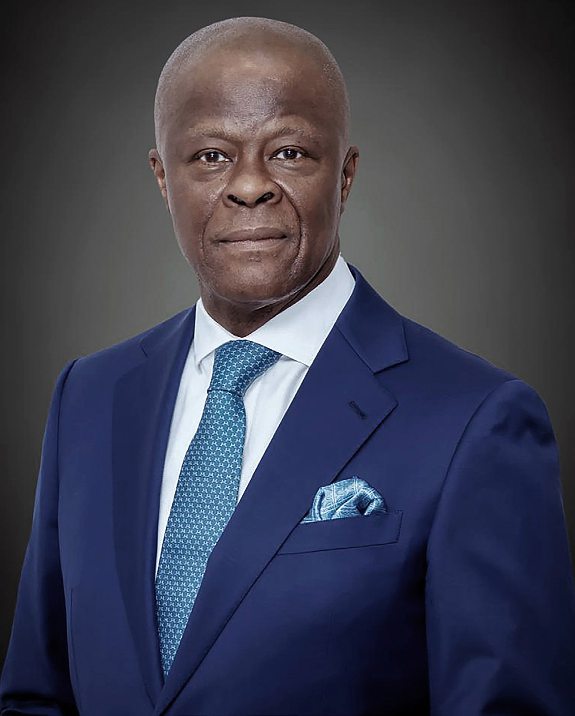

Wale Edun

“Betting on the future,

protecting the most vulnerable”.

Minister of Finance and Coordinating Minister for the Economy

Since May 2023 and the start of Tinubu's presidency, the country has been engaged in an ambitious and challenging economic reconstruction programme. This effort will be beneficial in the medium term, but will entail social costs in the short term. Finance Minister Wale Edun explains.

AM: Since your appointment a year and a half ago, how is the country’s economy faring?

Wale Edun: In the last 13 months the economy has been put back onto the road of macroeconomic stability, the road to economic recovery, the road to increased investments and increased productivity, growth, creation of jobs and reduction of poverty. As we all know, the country was economically and particularly fiscally in terms of government’s finances, was in very bad shape. On May 29, 2023 when President Bola Tinubu took over. Just as he had promised he immediately began to reform the economy. He removed a petroleum subsidy that was costing 2% of GDP which was approximately 5, 6, 7, 8 billion dollars, per annum.

In addition to suspending fuel subsidies, you devalued the Naira. These reforms triggered serious social riots.

Macroeconomic reform didn’t stop at the fuel subsidy. There was the foreign exchange subsidy, which was costing 2 to 3% of GDP, with foreign exchange being sold below market price. So we’ve fixed market pricing for petroleum, motor spirit, petrol, and foreign exchange. And based on this, the economy is getting a chance to recover, particularly government finance and the national oil company. That’s the core of the reforms. And, of course, we had underpricing of major assets that were benefitting just a few people who were involved in the subsidy and foreign exchange allocation regimes. Foreigners benefitted from petrol smuggled across the border. Moving away from that system naturally meant a rise in the price because there was no longer underpricing of those key resources: petrol, petroleum products and foreign exchange. Inevitably, when you move from such a system to another which, in the long term, will be more beneficial, you have to face up to the pain. That's what's happening here, and it's normal.

What concrete accompanying measures have you planned in the short and medium term to help the population cope with a staggering rise in the cost of living?

President Bola Tinubu has always been committed to ensuring that the poorest and most vulnerable are protected as far as possible from the worst effects of the rising cost of living as a result of these bold measures. Aid was put in place, as well as interventions, initially for farmers, smallholders, to obtain fertilisers, seeds, other inputs and cereals. We've really been able to free up the supply of foodstuffs on the market. In addition, more land has been brought under cultivation so that food is abundant, available and affordable, and production is increasing. In this way, we are helping to reduce prices and the cost of living for the average Nigerian. Direct payments have also been planned in collaboration with the World Bank, along the lines of the measures implemented during Covid, where people are provided with one-off emergency support. An initiative has been put in place to provide 15 million households, or around 75 million Nigerians in total, with three direct payments into their accounts, enabling them to meet their priorities. This initiative is ongoing. Sometimes, even when we have a good measure, implementing it can be complex. Because of the transparency, integrity and accountability required for such payments, a system had to be put in place to ensure that those on the social register – the 15 million households that were selected from the poorest 60% of the eligible population – were uniquely identifiable and biometrically enabled to be paid through a digital mechanism. It's not about handing out cash. This process has taken time in terms of identification and verification, but it is important to master it so that we can reach the poorest and most vulnerable in a targeted way. Similarly, subsidies to help the smallest micro-businesses and loans on preferential terms – at half or even a third of the cost of the normal interest rate – are available. So, at a time when the monetary authorities, led by the Central Bank, are fighting inflation by raising interest rates, there are affordable loans to support business, manufacturing and the productive sector.

Your stated ambition is to transform Nigeria. How long do you think it will take?

We have been reforming since the very first day that Mr President came to power and already the benefits are beginning to show. There are successes, there are improvements. The GDP growth rate has recovered, the balance of trade is strong, the current account balance is in surplus and growing. Inflation is being tamed. It went up slightly because of the recent adjustment to the fuel price, to make it market based so that both in foreign exchange and in petrol we have a market-determined price, not an administrative or subsidised price. There is progress in the budget deficit which is down from about 6.1% of GDP to about 4.4% of GDP. Likewise the debt service, the amount of government revenue that has been used to service loans is down from 90% of revenue or 100% of revenue let’s call it, to just over 60% of revenue. It’s still high, but it’s a lot better.

These are the types of improvements and they’ve been incentives in the oil and gas sector investment regime. Also the tax regimes have improved. We’ve removed withholding taxes for the manufacturing sector and encouraged manufacturing with tax incentives to employ more people. As a result, we’re seeing major investments in the oil sector from the likes of TotalEnergies, (6 billion dollars over several years) and, in early October, on the sidelines of the UN General Assembly, ExxonMobil announced a 10 billion dollar investment. And there are others. Some domestic manufacturers have stayed on the sidelines but they now see a market-oriented regime where the economy is stabilising and becoming more attractive. Even domestic investors are interested. I recently spoke with a businessman who told me that he had been holding back, but that he was now ready to invest 1.2 billion dollars in the productive sector, using the raw materials he extracts to make industrial products, inputs for other manufacturing companies. He’s now ready to go forward with that. He looked at the incentives available and he pointed to the ones that he’d like to take advantage of such as the concessionary interest rate financing. And we believe that this is going to be a common story, that those who have previously held back now look at the unfolding investment climate and they don’t want to wait any longer. They don’t want to be behind, they want to be first.

You regularly say that you favour investment over borrowing. Yet you continue to borrow. Is this temporary?

We’ve had to borrow concessionary cheap financing from multilateral development banks like the World Bank, and the African Development Bank. And we’ve also been able to raise money from Nigerians, particularly those with savings abroad by issuing – for the first time – landmark, historic, dollar bonds but using the Nigerian financial regulatory system. However, we borrowing because it’s necessary. The ultimate goal is to attract foreign direct and domestic investment, equity capital, and even government equity from taxes and increased revenue from oil production. In fact, production incentives in the oil sector have been improved and the quickest way for Nigeria to get foreign exchange and have liquidity in the economy, both in foreign currency and in Naira from public revenues is, of course, to increase oil production. But that takes investment, it takes security. We now have a much safer environment, because it's one of President Tinubu's priorities. It has led to more people returning to their farms to grow crops or engage in other pursuits, such as livestock rearing, fisheries, etc. But it's also positive for the oil sector, because improving security in this area is a priority for President Tinubu. But it's also positive for the oil sector, because improved security in this area is critical, as is increased surveillance and a reduction in theft and other losses.

For a while, Nigeria's oil production had been declining year on year. But recently it seems to have picked up again.

When the President came in he met oil production at about 1.2 million bpd, it’s up to about 1.6 now. The security forces and the Nigerian National Petroleum Company are committed to reaching 2 million bpd, taking advantage of the relatively high oil prices and the country's fossil fuel resources. We have also signed up to various protocols for clean energy, net zero and climate action but, at the same time, we have to be realistic. We have to use our fossil fuels to industrialize, to modernise our economy and lift our people out of poverty. And for the first time in forty years, we are refining crude oil locally, producing not only PMS (Premium Motor Spirit, a petrol produced by the Dangote refinery), diesel and Jet-A1, but also inputs, raw materials for the agricultural sector, fertilisers, raw materials for the textile, construction, chemical and pharmaceutical industries. So we are witnessing a renaissance, a revival of Nigeria's attempt to industrialise and modernise the economy based on private sector investment.

Apart from oil, you are seeking to diversify your economy. What sectors do you want to promote? You mentioned agriculture first, but what else?

Agriculture not only produces foodstuffs, but also materials such as ethanol, starch and many other inputs that can serve as the basis for an agro-industrial boom. That's why we're setting up agro-industrial zones all over the country. Products from the hinterland are now transported to a centre where there are warehouses, factories and equipment for processing, manufacturing, finishing, freezing, packaging and so on. In this way, raw materials are transformed into finished products closer to home. The various demands for these products are handled where the farmers are. Then, of course, there's the manufacturing industry. On the regional and even national market, there is strong growth in basic manufactured goods, household products and consumer goods for local export, and even across the continent as a whole. Africa has a population of 1.3 billion, and a regional population of around 300 million... So these are attractive markets for Nigerian producers and exporters. We are also interested in the housing sector. Nigerians have long-term savings, pensions and life insurance funds. By using these funds combined with concessional financing of 1% over forty years from the World Bank, we can offer a relatively low interest rate that people can bear, and then, of course, by investing the money over the long term, they can obtain mortgage loans over twenty or twenty-five years. This will give a boost to the middle classes, who often have enough money for a down payment but can't afford 30% interest rates or repay a loan in three years. This should trigger an increase in construction. Finally, we have an enormous demographic dividend, with around 600,000 graduates a year from various universities, both public and private. They have basic skills and can provide outsourcing services via the Internet. Population growth is tending to slow in countries where outsourcing is most prevalent, so there is a risk of a shortage of skilled labour, which Nigeria has in abundance. So the export of services is another very fertile area for the country to take advantage of. And, of course, we've improved our tax environment so that foreign companies can source services directly from Nigerians over the internet, without having to pay onerous taxes. Previously, to employ Nigerians, you had to be in Nigeria. But now we say no, stay in your country, employ Nigerians, they pay their taxes, that’s fine.

Who are Nigeria's main financial partners today?

Because we have to borrow, we look to concessional finance. The World Bank is a real partner, as are the African Development Bank and the French Development Agency. They aren't only looking at financing projects, but also financing budgetary support and the government’s macroeconomic reforms. We are grateful to these partners and we have, of course, relied on Nigerians to help us finance our exits. When we approach this market, we do so in such a way that the population can support us, both those in Nigeria and those in the diaspora, who have dollars or who keep their savings in foreign currency, probably because of the lack of strength of the domestic currency as a store of value. And then, of course, we have access to the Eurobond markets and we are no longer printing money to pay the bills. It's not easy, but we're meeting all our international and domestic debt servicing obligations.

You seem very confident about the future.

Yes, so far.