Nigeria exits FATF grey list

Nigeria has just turned an important page in its financial history. In Paris, on October 24, the Financial Action Task Force (FATF)—the global body responsible for combating money laundering and the financing of terrorism—announced that Nigeria, along with South Africa, Mozambique, and Burkina Faso, had been removed from its list of jurisdictions under increased monitoring, commonly known as the “grey list.” It marks a strategic victory for one of Africa’s largest economies, long viewed with caution by international investors. Since taking office in May 2023, President Bola Ahmed Tinubu has made restoring international confidence a top priority. Exiting the grey list stands as one of his first major achievements on the global economic stage.

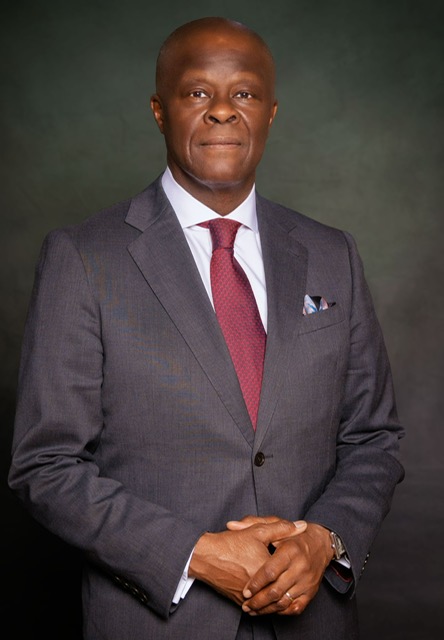

This FATF decision effectively recognizes a “credibility upgrade” for Nigeria’s financial system. Representing his country in Paris, the Minister of Finance and Coordinating Minister of the Economy, Wale Edun, expressed clear satisfaction: “This is a decisive signal to investors. It shows that Nigeria is open, compliant, and ready for deeper financial integration.”

According to the FATF, Abuja has “substantially implemented” the required reforms, particularly by strengthening the supervision of banks and financial institutions and increasing the number of suspicious transaction reports.

These advances were coordinated by the Nigerian Financial Intelligence Unit (NFIU), the Central Bank of Nigeria (CBN), and the Federal Ministry of Finance. The result: a stronger financial oversight architecture, now aligned with international standards.

A Political as Much as an Economic Victory

For Abuja, the decision comes at a pivotal moment. The reforms led by President Tinubu and Minister Edun are moving forward, but the country still faces persistent inflation, sharp naira volatility, and social tensions. Exiting the grey list could improve Nigeria’s sovereign rating, lower borrowing costs, and reassure major global financial institutions. “This could be a game-changer for access to international capital,” said a Lagos-based financial analyst. “The perception of Nigerian risk may shift significantly in the coming months.”

A Message to the African Continent

Africa’s demographic and economic giant is also sending a strong message to its neighbors: financial compliance is no longer optional—it is now a prerequisite for integration into the global economy. By leaving the grey list, Abuja regains diplomatic and financial room to maneuver, which could have ripple effects across the ECOWAS region.

The Challenge of Sustained Credibility

Experts caution that exiting the grey list is not the end of the journey but the start of a new cycle. Nigeria’s financial system will have to maintain its current discipline to avoid backsliding. The Tinubu administration is now playing on a stage where every reform matters and every signal to investors is closely watched. The FATF decision is indeed a victory. But its consolidation will be the real test.